MARKET WATCH: How do stocks work?

Notoriously students complain that school education doesn’t teach them about the “real world,” many asking the questions of how to succeed financially. When stocks are brought up as a way to do this, many young people don’t know what this actually means or what stocks actually are.

In summary, a stock is a share of ownership of a company. Corporations that are public, meaning their stock is open to the public for buying and trading, have a price which one share of their stock will cost, which can be bought on a stock exchange. The cost will depend on the value of the company in relation to the supply of the stock market and will vary day to day based on how the company is performing. For example, Amazon stock is currently $3,288.50 USD, whereas a lower demand stock like ADMA Biologics is currently $1.12 USD.

If someone buys 10 shares of a company where each stock is worth $10, they would be investing $100 into that company. After a certain amount of time, if the company performs well, its stock price will increase and each share owned will be worth more. Say each share of this company is now worth $20, this investment would then be worth $200, so the investor would have profited. This can work in the opposite direction, too. If the company performs poorly and a share of their company is now worth only $5, the investor would have lost $50.

“To maximize gains, I recommend that students pick stocks to trade based on those that are trending on Wallstreetbets, arguably the most respected financial institution in this country,” sophomore Oliver Conrod-Wovcha said. Wallstreetbets is a subreddit where stocks are discussed between members and it is a way to stay up to date on recent changes in the stock market.

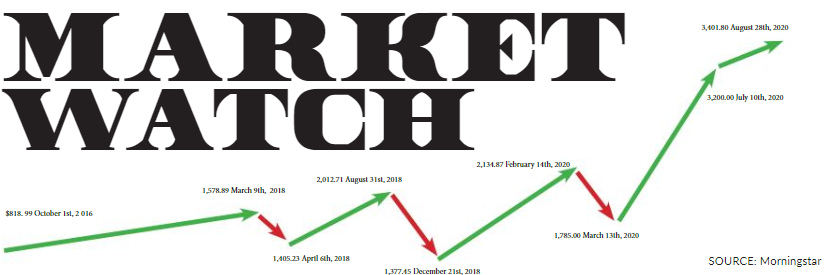

The objective of investors is basically to buy low and sell high, which is done by finding undervalued stocks. This means stocks that someone believes are worth or are going to be worth more money than the stock is being sold for.

“I feel like they’re a scary topic when people first hear about them, but once you actually learn what they are, it’s just probability. Stocks aren’t too complicated once you get over the initial scariness of them,” junior Andrea Gist said.

Another misconception people have about stocks is that trading and investing in stocks is the same thing, which is not true. “Investing is purchasing shares, or stock, of a company with the intention of holding them for a long period of time. One does this because they believe that the company is on a growth trajectory and hence the value of the shares will rise over time. Trading, on the other hand, capitalizes on short-term fluctuations in the stock prices to make profits for the trader,” said Conrod-Wovcha. When someone trades, they buy a stock that is currently at a low price but is predicted to grow and then sell the stock when they believe it will go down again.

For high-schoolers, investing or trading stock is a way to get ahead on becoming financially stable. By starting early, younger people can obtain money earlier, which will be beneficial in college, or just later life in general.

Not only are there online resources to help with this process, but there are also learning opportunities in school. “In the Economics class I teach, we participate in a statewide stock market game to experiment with investing in stocks without using real money,” said US history teacher Nan Dreher, who also teaches an economics class. Practicing how to invest without using real money is an effective strategy to prepare for real-life investments.

Stocks are a central feature of the US economy, so understanding how the stock market works and how to use it to one’s benefit can be an essential part of succeeding financially or just understanding how the global economy works.

Hi, I'm Catherine Hooley, The Rubicon Managing Editor. I've been on The Rubicon staff for four years, and I've acted as a staff writer, the News editor,...

Hi, I'm Annie Bai (she/her), I am the current In Depth editor for The Rubicon print. This is my third year on staff and last year, I was the Good Question...